Market Update

LDL RESEARCH PRESENTS: Are Rates Too High? Just Right? Depends on Who You Ask

Much has been made of the volatility in the bond markets this year and rightfully so. Over the past few months it became relatively common to see Treasury yields move higher or lower by 0.20% a day—something that hasn’t happened in decades and a large departure from the 0.05% moves that are considered normal. However,…

Read MoreLPL RESEARCH PRESENTS outlook mid year 2022- Navigating Turbulence

Markets rarely give us clear skies, and there are always threats to watch for on the horizon, but the right preparation, context, and support can help us navigate anything that may lie ahead. So far, this year hasn’t seen a full-blown crisis like 2008–2009 or 2020, but the ride has been very bumpy. We…

Read MoreIs There Any Value Left in TIPS?

Posted by Lawrence Gillum, CFA, Fixed Income Strategist July 12, 2022 The consumer price index (CPI) is scheduled to be released on Wednesday and it is widely expected that the headline inflation number will again resemble consumer price increases last seen in the early ‘80s. Currently, consensus expectations are for headline inflation numbers, which include food…

Read MoreHow Our Economy Can Bounce Back

Stocks have weakened as various global concerns keep popping up. Stretched valuations, weakening technicals, and increased tensions between the United States and China have investors on edge. This week, the LPL strategists discuss these important concepts, and more. How bad is it Retail sales fell 16.4% over the past month, the largest monthly decline…

Read MorePulse Check: Should You Ignore the Economic Data and Pullback Odds Are Increasing

More bad economic data A record 20.5 million people lost their jobs in April, well above the previous record of 2 million during World War II. This is further confirmation of how quickly our economy stopped, and the LPL strategists noted that the unemployment rate of 14.5% will likely continue to trend higher over the…

Read MoreResilience, Perseverance, and Innovation

Stocks hit a rough patch the last week of April, as the historic rally could be tiring. The news was heavy and the economic data continued to be very weak, but central banks are doing all they can to help weather the storm. Central banks are all in The LPL Research strategists discuss how the…

Read MoreHave Stay-At-Home Growth Stocks Peaked?

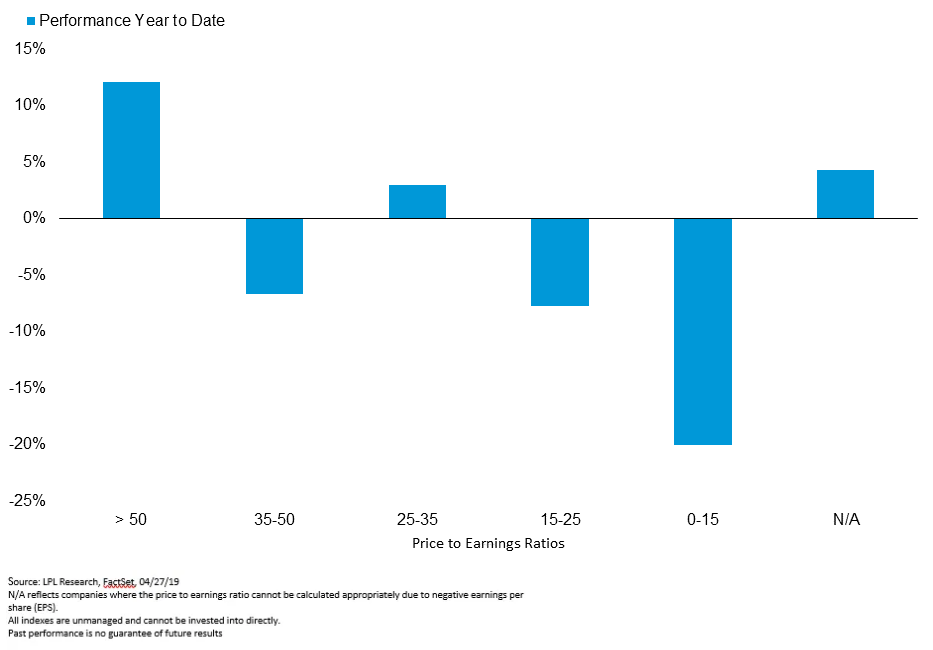

Over the past couple of weeks, we have thankfully witnessed new cases of COVID-19 in the US trending lower. Increasingly, we are also seeing governors implementing plans to re-open their state economies in phases. If the US economy continues to open up and economic growth starts to rebound, relative performance of stay-at-home growth stocks may…

Read MoreWhen Will The Recession Officially Start?

With 22 million jobs lost in the past four weeks, a record drop in retail sales, and huge drops in industrial production and housing starts, it is safe to say we are likely in a recession. Even the Federal Reserve (Fed) in the recent Beige Book said that “economic activity contracted sharply and abruptly.” We…

Read MorePutting Things in Perspective

The economic data keeps getting worse, yet stocks have been in the midst of one of the greatest multi-week rallies ever. As the LPL Chart of the Day shows, the S&P 500 Index gained 27.2% in the 15 days after the March 23 lows, the greatest three-week rally since 1933. Take note, this rally took place…

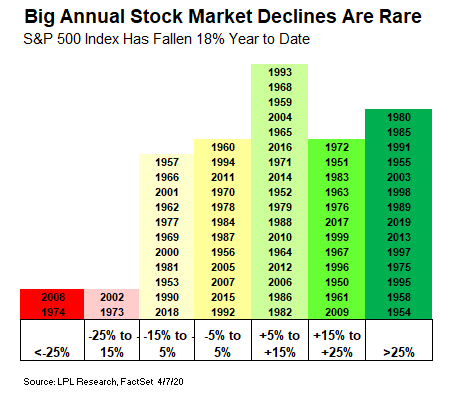

Read MoreBig Annual Declines Are Rare

Stocks have rallied nicely off the March 23 lows on the back of a bold policy response from the Federal Reserve (Fed) and lawmakers in Washington, DC, which was followed by signs that a peak in growth of COVID-19 cases may come soon. At Wednesday’s close, the S&P 500 Index stood 19% above the March…

Read More