Market Update

Is a Depression Coming?

“Could there be another depression” is one of the top questions we’ve received over the past week. “Yes, we are in a recession and many are worried if things may get much worse before they get better,” explained LPL Financial Senior Market Strategist Ryan Detrick. “But we continue to think the double-barrel of support from…

Read MoreMarket Volatility Stresses Liquidity

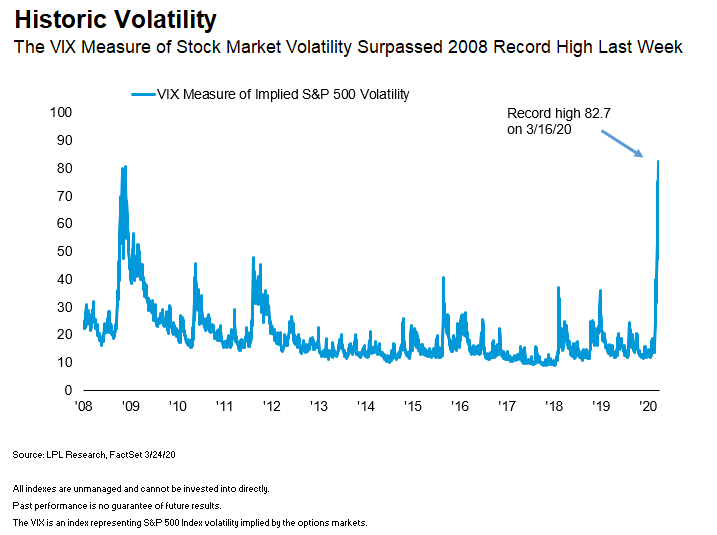

The COVID-19 pandemic has caused unprecedented volatility in recent weeks that has investors and traders scrambling to assess the economic and market impact of the aggressive containment measures. This past week the CBOE Volatility Index (VIX), which measures the implied 30-day volatility of the S&P 500 Index based on options contracts, measured its highest reading…

Read MoreHow Quickly Can Stocks Recover From COVID-19?

The market volatility continues, as the S&P 500 Index has closed either up or down 4% or more for a record 7 consecutive days. With the S&P 500 Index down 30% from the highs, it has officially moved into a bear market. Yesterday, we took a look at how stocks did after the lows of major…

Read MoreMarket Insight – Another Look At Election Years

MARKET BLOG Last week in our LPL Research blog, we took a closer look at how stocks have performed during an election year. We found that since 1940, the S&P 500 Index hasn’t been lower during an election year when an incumbent president has been up for reelection. We’ve had many requests to look more into…

Read MoreMarket Update – Why The First Five Days Of 2020 Could Have Bulls Smiling

The first five days of 2020 are in the books. Although the headlines have been quite scary, equities have picked up right where they left off last year. In fact, after the first five trading days of the new year, the S&SP 500 Index is up a respectable 0.65%. Jeffrey Hirsch of The Stock Trader’s Almanac follows…

Read MoreMarket Update – Don’t Fear the Repo

The fourth quarter is winding down, and investors are getting nervous that volatility in the short-term lending market could flare up once again. Rates on repurchase agreements (repos) jumped in September 2019 amid a shortage of cash available to lend, forcing the Federal Reserve (Fed) to restore balance in the system by purchasing U.S. Treasuries…

Read MoreMarket Update – Consumer Inflation Hovers Around Cycle High

The core Consumer Price Index (CPI), which excludes food and energy prices, rose 2.3% year over year in November, just below a cycle high of 2.4% growth last reached in September 2019. Inflationary pressures have recovered noticeably since slowing earlier this year, as shown in the LPL Chart of the Day. Core CPI has increased…

Read MoreGiving Thanks for the U.S. Consumer

Giving Thanks for the U.S. Consumer This Thanksgiving, we’re thankful for solid consumer confidence, even though it has wavered in recent months. Consumer confidence fell for a fourth straight month in November, according to preliminary Conference Board data. Even though the Conference Board’s Consumer Confidence Index has dropped from its economic cycle peak, consumer sentiment…

Read MorePutting The Bull In Perspective

The S&P 500 Index has closed higher five consecutive weeks, making six new all-time highs along the way. There now have been 19 new highs in 2019, tying the number we saw last year. There’s no doubt that this bull market has been incredibly impressive, especially lately. But, it may also be quite misunderstood. For…

Read More