Pulse Check: Should You Ignore the Economic Data and Pullback Odds Are Increasing

More bad economic data

A record 20.5 million people lost their jobs in April, well above the previous record of 2 million during World War II. This is further confirmation of how quickly our economy stopped, and the LPL strategists noted that the unemployment rate of 14.5% will likely continue to trend higher over the coming months. Earnings season is wrapping up, and although there were some strong earnings reports last week, Q1 earnings are now expected to be down 13% year over year and could be down significantly more next quarter.

Ignore the bad economic data?

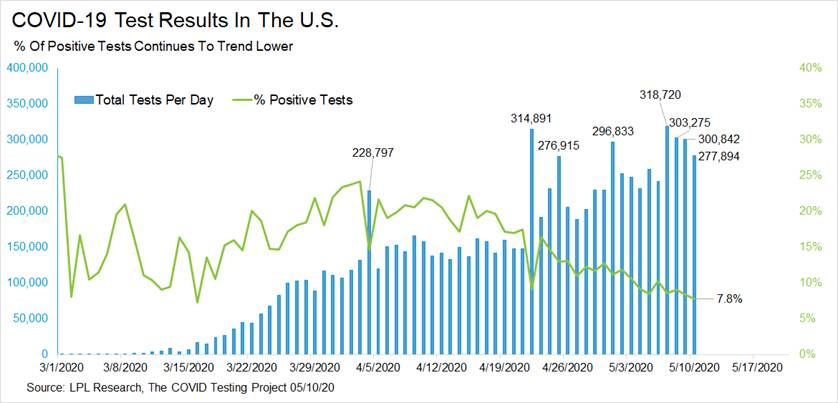

In the face of historically bad economic data, stocks have soared higher over hopes of reopening the economy and positive trends in COVID-19 cases. Should we just ignore the data? The LPL strategists don’t feel we should blindly ignore the economic data, and instead focus on some of the more real-time data, like jobless claims and the number of people booking dinner reservations or flying on a plane. Some good news is testing has soared in the US, while the number of positive tests as a percentage of all test has continued to trend lower.

Time for a pullback?

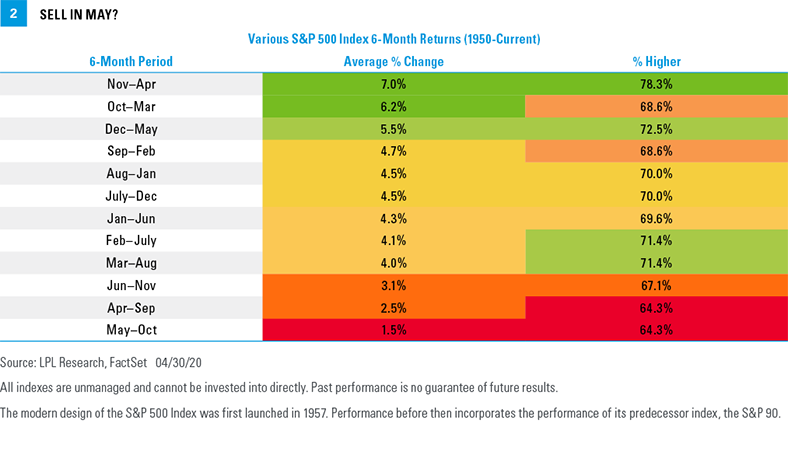

Stocks have gained more than 30% since the March 23 lows, but as the LPL strategists point out, it could finally be time for a well-deserved pullback. We are seeing less stocks participate in this rally, while the worst six months of the year are upon us. Looking at last year, stocks had their largest sell-off during the May/June period. A pullback in the range of 10% could be perfectly normal and healthy over the longer term.

Tune in now

Listen to the entire podcast to get the LPL strategists’ views and insights on current market trends in the US and global economies. To listen to previous podcasts go to Market Signals podcast. You can subscribe to Market Signals on iTunes, Google Play, or Spotify.

_______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth in the podcast may not develop as predicted and are subject to change.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The source for the unemployment numbers discussed in this podcast is the US Department of Labor.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Member FINRA/SIPC

For Public Use — Tracking #: 1-05008976