Deep Dive – July 2024

Clients and friends, Hope your summer is going well and are able to spend time with family and friends.

Below is a deep dive for some summer reading on the topic of Tax, Spend and debt.

With market volatility picking up, at the epicenter is government debt, both here and around the world. Leadership will be required and I am optimistic that this is a solvable problem.

Attached is a picture from Estero Island from a family trip a short time ago, I do hope you are able to relax and enjoy the summer.

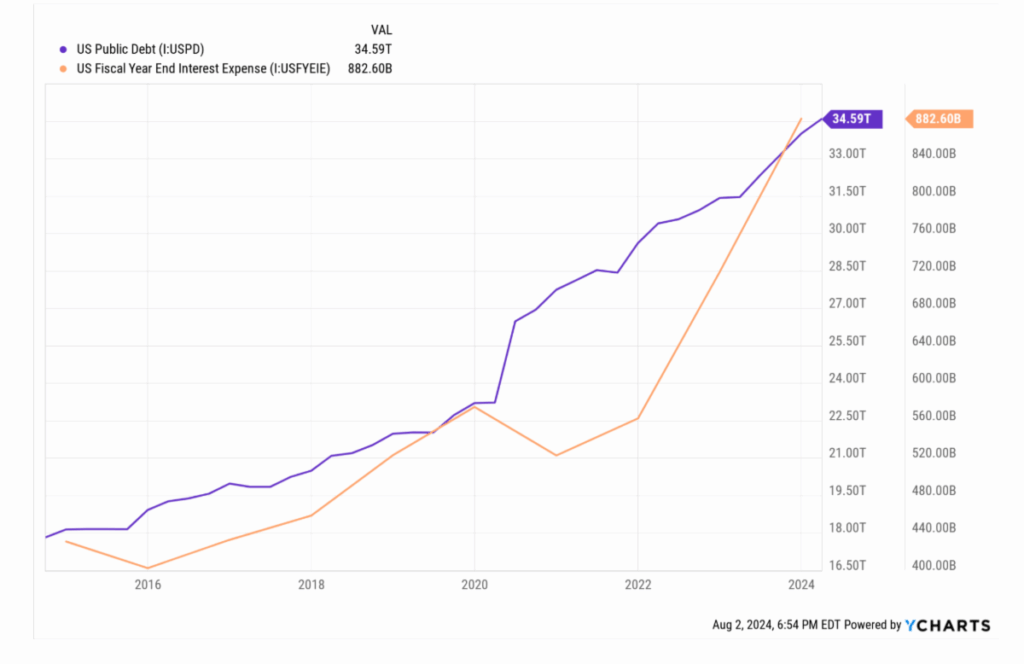

United States Debt 2019 or “Pre Covid” was 22.7 Trillion, as of August 1st 2024 its 35 Trillion, some of this debt is held by our Government like the Federal Reserve but none the less, its debt that in 5 short years is up over 50%.

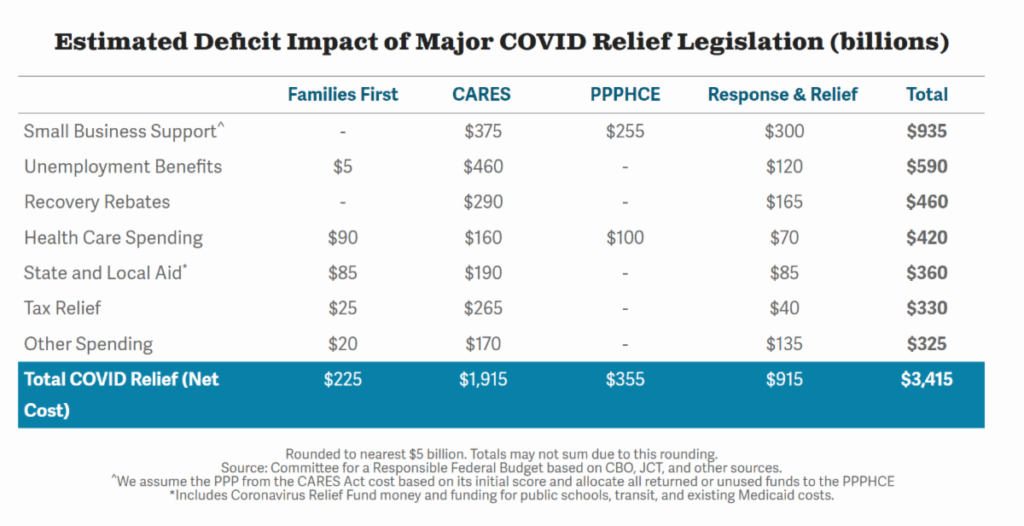

Lets have a look at the Spending towards COVID and Economic Recovery from COVID below.

The Financial commitment from our Government for COVID-19 generally refers to the 4 Bills below that total $3.415 Trillion.

March 2020

- Coronavirus Preparedness and Response Supplemental Appropriations Act $915 Billion

- Families First Coronavirus Response Act $225 Billion

- Coronavirus Aid, Relief and Economic Security Act 1.9 Trillion

April 2020

- Paycheck Protection Program and Health Care Enhancement Act $355 Billion

The breakdown to how this was allocated is listed below in the chart.

Two additional Bills provided some additional funding towards COVID and the Economic Recovery associated with the pandemic a total of $2.8 Trillion.

December 2020

- Consolidated Appropriations Act, 2021 $2.3 Trillion of which $900 Billion allocated towards Coronavirus funding.

March 2021

- American Rescue Plan Act of 2021 $1.9 Trillion

The total funding during the 2019/2020 fiscal years totaled $6.2 Trillion for COVID and Economic Recovery.

This type of spending is very unusual, its what we typically would spend during War/Conflicts while Raising Taxes to offset the spending.

Lets have a look at two past examples:

World War II

1939, there was 34 different Federal Income Tax Brackets, but the majority paid zero Federal Income Tax, the top Tax Rate went from 79% to 94% for those with incomes $200,000+, equivalent to 2.5 Million in income today but also very interesting was in 1940 only 7% of our population was paying Federal Income Tax, by 1944 that increased to 64% so a very broadening out of the tax base.

Vietnam War

Revenue and Expenditure Control Act of 1968 was a temporary law put in place for about 18 months, it assessed a 10% surcharge on Income Taxes to Business and Personal Tax.

*research provided by Perplexity AI on the above two items

If we look at the chart below, it is showing our debt at 34.59 Trillion and the Interest on this Debt at 882 Billion, there have been a number of recent articles written discussing how our Interest is now over 1 Trillion come the next fiscal year on October 1 2024.

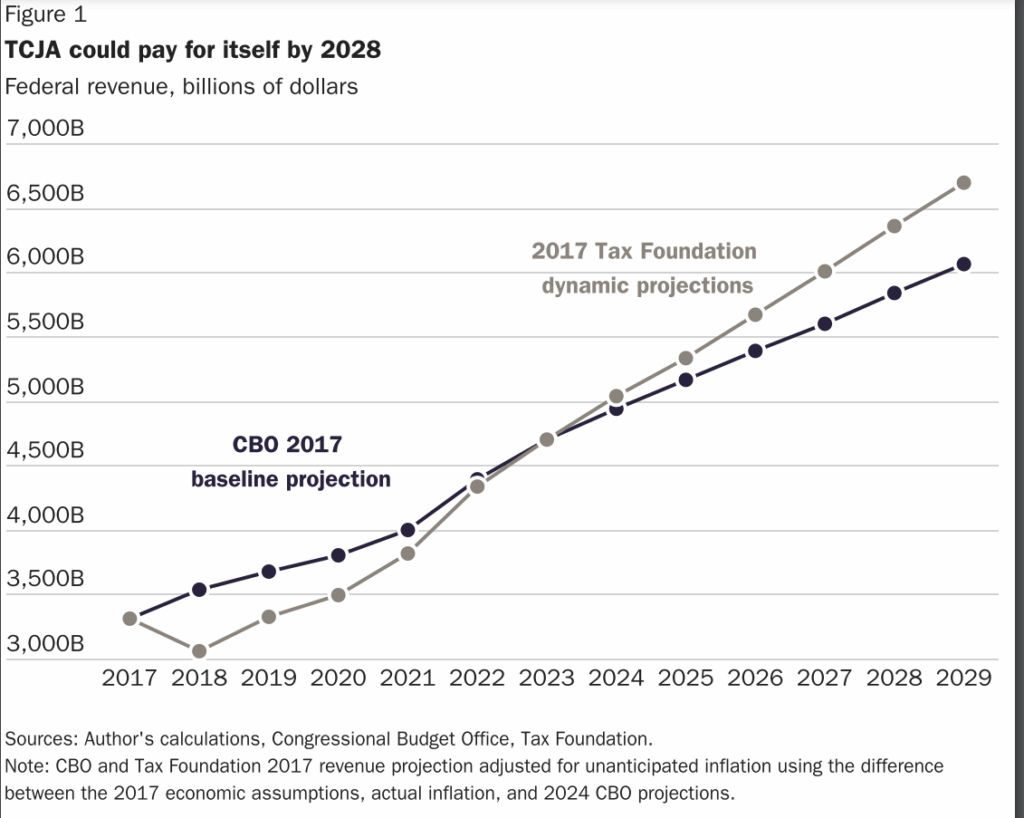

The Tax Cuts and Jobs Act of 2017 which put in place the current tax brackets is set to expire in 2025, the Initial idea of this Act was to lower taxes for both Personal and Business Tax and Increase exemptions like Estate Tax. The total bill was based on “static” accounting with a loss of revenue of about 1.5 Trillion over 10 years, using a more “dynamic” approach to revenue with adding in the investments gained by lowering taxes it shows the bill paying for itself 2024/2025 time period.

However since COVID Recovery and Economic Stimulus has blown a large hole in the budget, the current tax law expiring its safe to say Taxes will be going up, and broadening out as it has in the past.

Currently, a Married couple with 2 kids and total income of about $75,000 zero federal income tax, $90,000 would have income tax rate at about 6%, if Income was at $125,000 a tax rate of about 12% and I would anticipate Income Tax going up for all starting in 2026 regardless of who wins the Presidency this year.

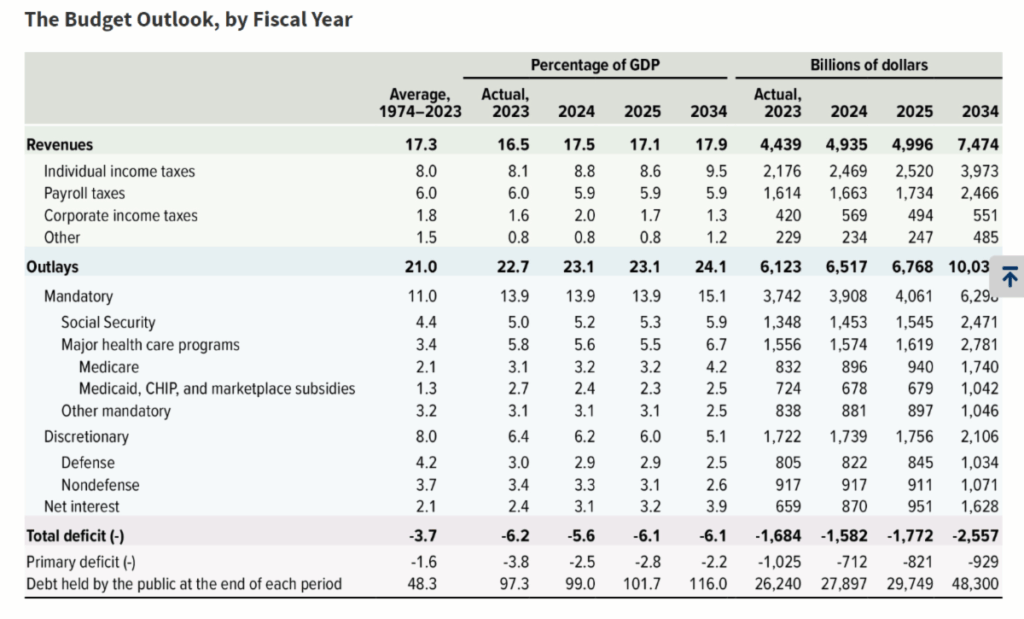

In looking at the Budget below, it shows total revenue of about 4.9 Trillion for fiscal year starting October 1st 2024, and with anticipate Interest on our Debt at 1 Trillion that is about 20% of our total Revenue. This is why preparing for higher taxes should be considered and discussion around saving tax deferred, Estate Tax planning important and we can run the numbers and discuss strategy at any time.

With our Government spending at about 6.5 Trillion, and our Tax Revenue at about 5 Trillion, I would anticipate an increase of about 2.2 Trillion in Tax increases over the next cycle and with solid leadership a real scrutiny on spending, and lowering the interest rates while extending out maturities on the debt.

Thank you for reading and as always, if you have any questions please reach out, enjoy the balance of summer.