Posts by Craig Brown

Market Volatility Stresses Liquidity

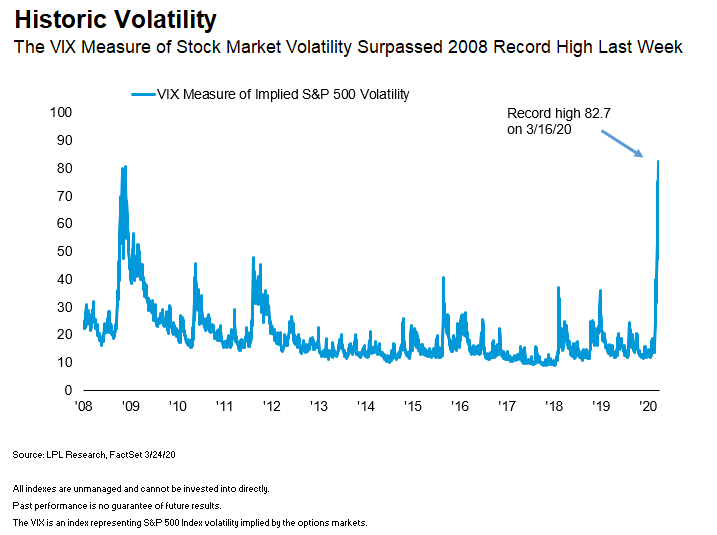

The COVID-19 pandemic has caused unprecedented volatility in recent weeks that has investors and traders scrambling to assess the economic and market impact of the aggressive containment measures. This past week the CBOE Volatility Index (VIX), which measures the implied 30-day volatility of the S&P 500 Index based on options contracts, measured its highest reading…

Read MoreHow Quickly Can Stocks Recover From COVID-19?

The market volatility continues, as the S&P 500 Index has closed either up or down 4% or more for a record 7 consecutive days. With the S&P 500 Index down 30% from the highs, it has officially moved into a bear market. Yesterday, we took a look at how stocks did after the lows of major…

Read MoreLow Valuations Imply Better Long-Term Performance

The dizzying volatility over the past few weeks has left all of our heads spinning as we wait for containment efforts in the United States and elsewhere to help slow new cases of COVID-19 (coronavirus). Public health is of course our primary concern. But beyond that, from an economic and market perspective, there are many difficult…

Read MoreFamily Business—Laying the Groundwork for Potential Success

Is your growing business still a one-person operation? As your company continues to grow and the workload increases, it is easy to find yourself wearing too many hats and not having enough hours in the day to accomplish everything that needs to be done. At such a turning point, many small business owners turn to…

Read MorePut Savings (and Yourself) First with a Budget

Americans, it seems, are spenders. Personal savings rates are low and many people spend beyond their means. If you’re among those Americans who can’t seem to save, it might be time to create a budget. A budget allows you to understand where the money goes and may help you free up cash for important savings…

Read MoreShould I invest a lump sum or use dollar cost averaging when investing in a 529 plan?

There’s no right answer — you can do either. For some parents, contributing smaller, regular amounts to a 529 plan is preferable because they might not have the discretionary income to invest more. One way to put your monthly contributions on autopilot is to set up automatic monthly debits from your checking or savings account…

Read MoreUrgent Market Update – Corporate America Impresses

Corporate America impressed us this earnings season. Though S&P 500 Index companies have generated only 1–2% earnings growth compared with the year-ago quarter, we consider this an excellent result given the challenges companies faced in late 2019. The challenges have not let up in 2020, however, with significant disruptions for U.S. companies operating in China…

Read MoreFinancial Wellness: Establishing an Emergency Fund

First, the car broke down, then the dishwasher stopped working, and now the dog is sick. Sometimes the old proverb, “It never rains but it pours,” seems to ring a little too true. When you need money to pay large, unexpected bills, where do you turn? Many people use credit cards or borrow from their…

Read MoreProtect Your Assets With a Trust

A trust is a legal entity that is central to a three-part agreement in which an individual — the trust’s “grantor” — transfers the legal title to an asset to that trust for the purpose of benefiting one or more beneficiaries. The trust is managed by one or more trustees. Trusts may be revocable or…

Read MoreIs Long-Term Care Insurance a Good Idea?

There is a good possibility that you or your spouse will eventually require some form of long-term care (LTC). According to the Centers for Medicare & Medicaid Services, at least 70% of people aged 65 or older will require some form of long-term care services and support during their lives.1 Whether you or your spouse…

Read More