LPL RESEARCH PRESENTS outlook mid year 2022- Clearer Skies for Core Bonds

The value proposition for core bonds (as defined by the bonds within the Bloomberg Aggregate Bond index) is that they tend to provide liquidity, diversification, and positive total returns to portfolios. Unfortunately, none of those values is 100% certain all the time. Like all markets, fixed income investing involves risks and, at times, negative returns. However, despite the historically poor start to the year, the value proposition for core bonds has actually improved recently. Investing is a forward-looking exercise and with the back-up in yields that has already taken place this year, we believe now could be as good as it’s been in quite some time for core bonds.

Rapidly ascending rates

Importantly, yields have moved higher because of the changing expectations of higher short-term interest rates and not an increase in credit risk. Coming into 2022, markets were only expecting one or two short-term interest rate hikes by Fed this year, with most of the hikes expected to come in 2023. However, markets have aggressively re-priced the number of potential Fed rate hikes and now expect as many as 13 by year-end. As such, the yield on the 10-year Treasury security has more than doubled this year after increasing around 100 basis points (1.00%) off its lows in 2020. The 250 basis points (2.5%) move higher that has already taken place this cycle is the biggest move higher in yields since 1994, when rates moved higher by 280 basis points—and that was at the end of the rate hiking cycle. So, with so many rate hikes priced in at this point, we think the worst could be behind us. So have rates peaked? Historically, rates have tended to move a lot before the first rate hike (like they’ve done this year) but they still move marginally higher throughout the rate hiking process. Typically rates don’t actually make a top until inflation peaks and the Fed stops raising rates, two things that clearly haven’t happened yet, as this cycle has only just started really. That doesn’t mean we will see significantly higher yields—we don’t think we will—but we could see 3.50–3.75% on the 10-year this year, which would likely be the top in yields for this cycle, in our view. As rate hikes work their way through the economy and slower growth starts to get priced in, we expect to see the 10-year Treasury yield end the year between 2.75–3.25%.

No more TINA?

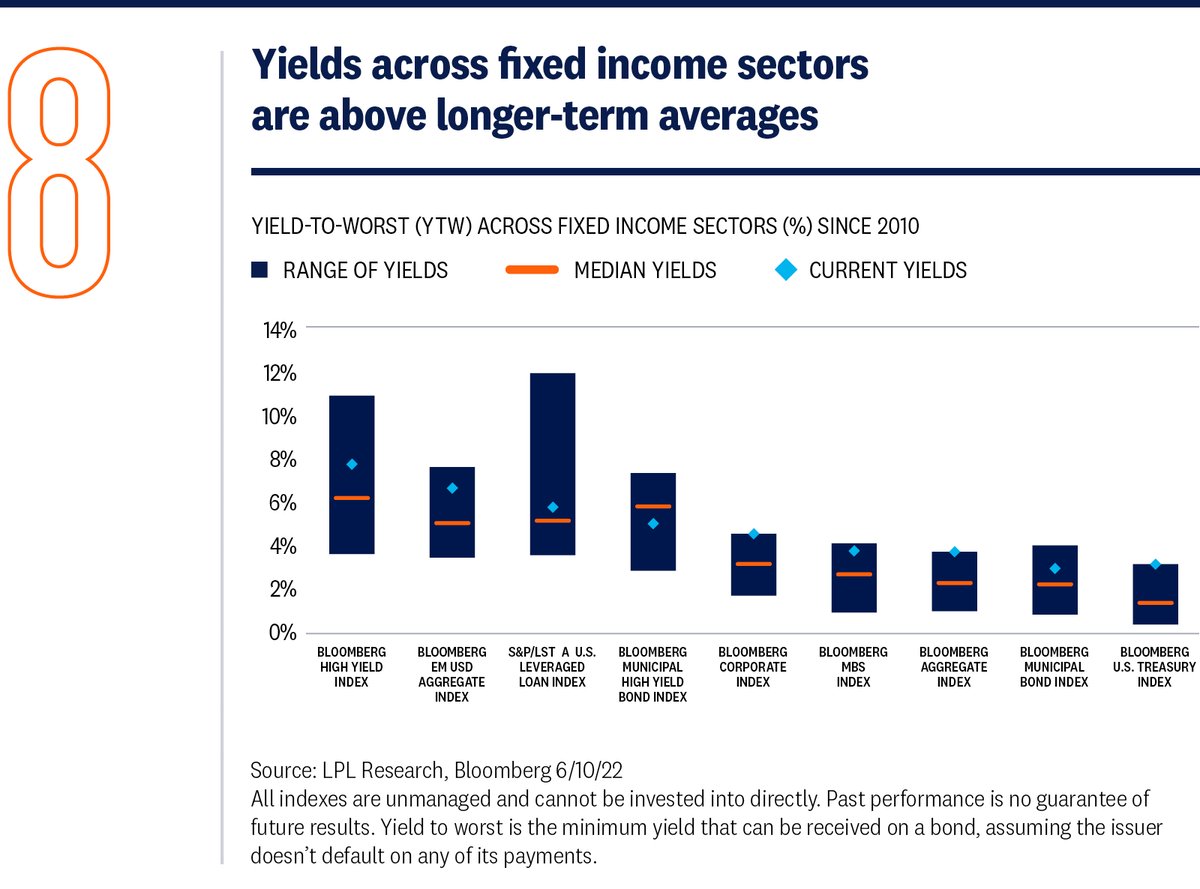

TINA, or “there is no alternative” has been a big reason diversified asset allocation portfolios have been overly geared toward equities over the past few years. The relative attractiveness of equities over fixed income was undeniable when interest rates were hovering around all-time lows. Now that interest rates have moved higher recently, though, the relative attractiveness between stocks and bonds is much more balanced. But for investors unwilling or uninterested in taking on additional equity risks, there are a number of fixed income markets with yields trading above long-term averages. The yield on most fixed income asset classes is hovering around the highest levels we’ve seen in a decade [Fig. 8]. And for the Bloomberg Aggregate index, yields are the highest they’ve been since 2010. Since starting yield levels are the best predictor of future returns, following the big move higher in yields this year, future returns look more attractive than they have in years. With interest rates so low over the past few years, the back-up in yields could be an attractive opportunity for income-oriented investors. And while we can’t guarantee that interest rates won’t go higher, at current yields, the risk/reward for owning fixed income has improved dramatically, in our opinion.

We still think maintaining a slight underweight to the most interest-rate sensitive assets is appropriate, although we are more likely to increase exposure to longer-maturity/duration bonds as the year unfolds given our view on rates. Additionally, we think mortgage-backed securities and high-quality short-to-intermediate corporates are attractive areas within the taxable fixed income market. Next, we think the high-quality national municipal market is as attractive—from both a fundamental and valuation perspective—as it’s been in quite some time. Finally, for income-oriented investors, high-yield corporate bonds may be an attractive option. However, we still expect above-average levels of volatility as the Fed removes monetary accommodation.

Diversification benefits of bonds may be improving

Since 2000, the correlation between stocks and bonds has generally been negative—that is as equity prices were falling, bond prices were rising—although there has been considerable variation with that relationship [Fig. 9]. And at times, the relationship between stocks and bonds has, in fact, been positive. As a result, the historical correlation between stocks and bonds is actually close to zero—meaning it’s generally noisy. In other words, it isn’t that uncommon to see equity and bond prices moving lower (or higher) at the same time, i.e., correlations well above zero. That said, now that interest rates have soared off the all-time lows set back in August 2020, there is more of a cushion to act like a diversifier during equity market drawdowns. The back-up in yields this year has certainly been painful, but the ability for fixed income to act as an equity buffer has increased, in our view. As bond and equity markets both move past the aggressive repricing of Fed rate hikes that have caused both markets to sell off this year and grapple with a potential slowdown in economic growth, we believe bonds are likely to provide that safety net for portfolios again as we move through the year.