LPL RESEARCH PRESENTS outlook mid year 2022- Equities Face Heavy Cloud Cover

Stocks will face a number of headwinds in the second half of the year, but the amount of turbulence will likely depend on the pace at which inflation falls. It’s tough to see the bull case through the cloud cover right now, and volatility may persist, but an improved macroeconomic environment may set the stage for higher valuations, further earnings growth, and solid gains for stocks over the rest of the year.

Several factors causing turbulence

Stocks faced many challenges in the first half of the year. At the top of the list were rampant fears of recession as the Fed began to pull back monetary policy support and pushed interest rates higher to combat high inflation. The Fed’s track record of fighting inflation without causing a recession is not reassuring. More often than not, its rate hiking campaigns have preceded (or caused) recessions—though typically at interest rates above current levels. Nonetheless, high inflation has been a common ingredient in recessions since WWII—see the 1970s, early 1980s, early 1990s, and even 2008. Add to that, an unexpected war in Eastern Europe and lingering—though diminishing—effects of COVID-19 on global supply chains, and the skies are far from clear.

Easing inflation pressure is key

The amount of time it takes for stocks to return to prior highs will be largely determined by the path of inflation. LPL Research expects perhaps 1.5 percentage points to come off of core consumer prices by year-end—the latest reading for the Fed’s preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Index excluding food and energy for April, was 4.9%. Lower inflation tends to bring higher valuations [Fig.5]. The market clearly does not expect 8% inflation to persist based on current stock valuations, but whether inflation eventually settles at 2%, 3%, or 4% will go a long way toward determining how much higher stock valuations can go from current levels.

Earnings trajectory leveling off

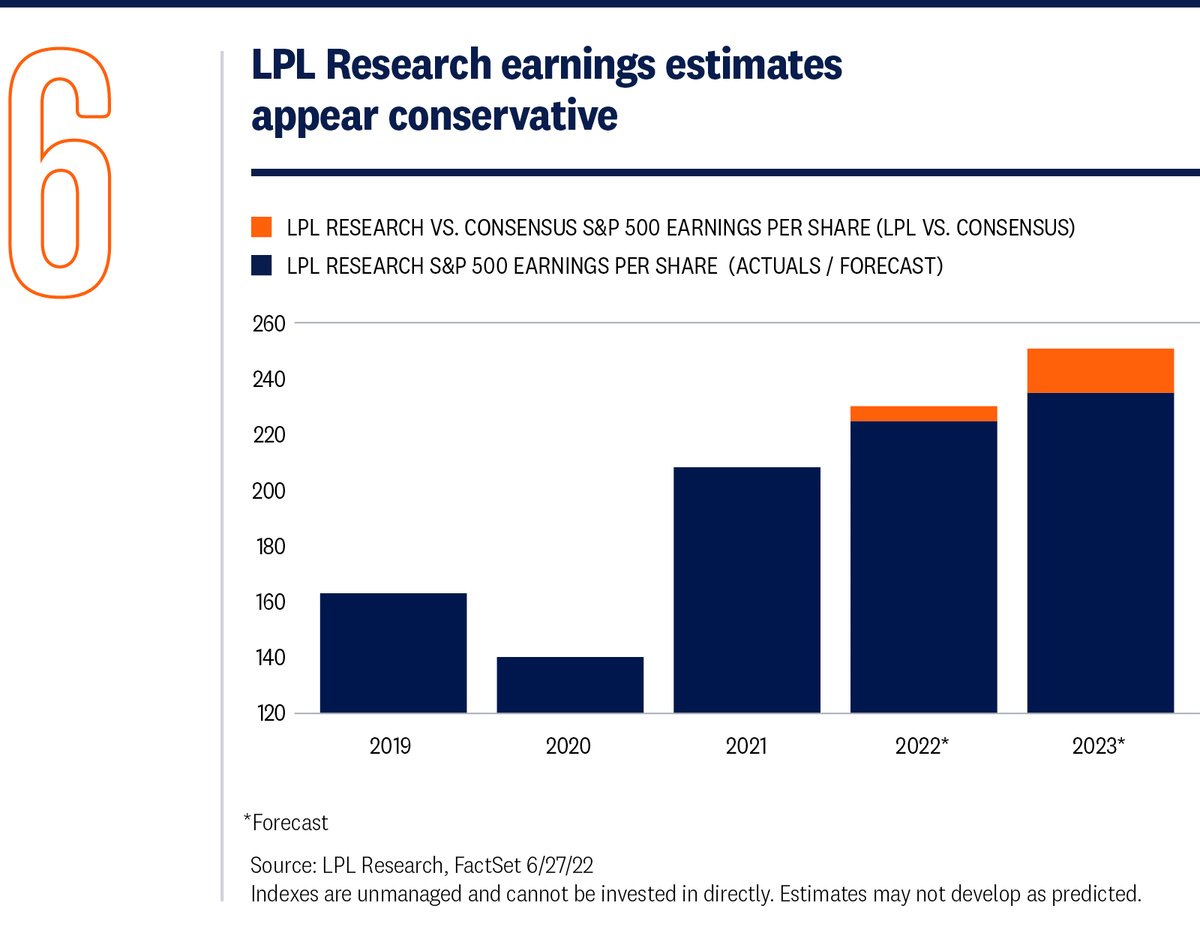

First quarter earnings season wasn’t exactly pretty, but given the difficult environment, a roughly 10% increase in S&P 500 earnings per share (EPS) and nearly 14% increase in revenue, both solidly above expectations, were excellent results. Companies were generally able to pass through price increases to limit pressure on profit margins amid higher materials and transportation costs, labor shortages and rising wages, and various supply chain disruptions. Solid first quarter results set corporate America up to potentially grow S&P 500 EPS by 8% in 2022 to $225 per share. That forecast is still about $5 below the consensus estimate and potentially conservative [Fig. 6]. Our forecast for 2023 is $235, a mid-single-digit increase over our 2022 forecast and more than $16 below the consensus estimate of over $251 per share. We expect mid- to high-single-digit earnings growth this year and next to help support a stock market turnaround in the months ahead.

Lift from valuations, drag from margins

As of June 27, the S&P 500 Index was trading at a price-to-earnings ratio (P/E) of about 15 times consensus 2023 S&P 500 EPS, slightly below the long-term average. If U.S. economic growth picks up in the second half as inflation falls, calming recession fears and supporting earnings growth, we would expect valuations to get a nice lift by year-end.

But will profit margins be a drag? Current margins may support above average valuations, but cost pressures remain intense as inflation has been stubbornly slow to come down. Labor markets are still tight. Commodity prices are still high, especially oil. Supply chains are improving but remain a challenge, keeping prices for certain inputs elevated. Revenue growth is expected to slow with the economy, leaving less cushion for companies to hit their margin targets. These potential headwinds to profitability may make it difficult for corporate America to maintain its current high-single-digit earnings growth pace, but our base case calls for steady earnings gains through 2023.

Limited visibility

With so much uncertainty, this is a difficult stock market to forecast. The range of potential outcomes is wider than most years. The challenge comes from predicting how fast inflation will come down, which will determine how much profit margins narrow, how fast earnings can grow, and where interest rates eventually land. The opportunity for a strong second half is not hard to see. Earnings growth and higher valuations can be a powerful combination. Our base case expectation calls for a P/E of 18–19 and $235 in S&P 500 EPS in 2023, resulting in a year end S&P 500 fair value target range of 4,300 to 4,400 [Fig. 7]. That’s an attractive destination from the market’s current location, though the flight path may not be a straight line. The wide range reflects the high degree of uncertainty and the possibility stocks get re-routed.

Market Cap

LPL Research favors a benchmark-level exposure to small, mid and large cap stocks for the second half of 2022 (compared with the LPL Diversified benchmark). Although large cap stocks may be better positioned for a late-cycle economy, small and mid cap stocks enjoy attractive valuations and may benefit from greater exposure to a potential second half rebound in the U.S. economy.

Style

Growth-style stocks were trounced by their value counterparts in the first half of 2022. As the second half gets underway, with inflation still very high, leaning toward the inflation beneficiaries on the value side such as energy may still be prudent. Once inflation starts to come down and economic growth and interest rates potentially stabilize, growth performance may begin to turn around.

Sector

LPL Research recommends a modest tilt toward defensive sectors and away from cyclicals as the second half begins with uncertainty still elevated. Our favored defensive sectors include healthcare and real estate, while the near-term outlook for the energy sector remains positive on both a fundamental and technical basis. The aforementioned conditions for a style shift toward growth (falling inflation, stabilizing economic growth, and interest rates) may also drive a turnaround in the leading growth sector, i.e., technology, so that is one to watch for the second half of the ye

Region

The U.S. economy appears better positioned than Europe to withstand higher energy costs, particularly Germany which is very reliant on Russian energy, supporting LPL Research’s preference for U.S. equities over their developed international counterparts. Headwinds for U.S. stocks include the large weighting in the technology sector and strong U.S. dollar. Our outlook for emerging market (EM) equities is neutral, as geopolitical risk offsets the reopening of China’s economy and attractive valuations. The U.S. dollar is a wildcard but a potential reversal lower after such strong first half gains could be supportive.

© 2022 LPL Financial LLC Tracking #1-05292601 (Exp. 7/23)