LPL RESEARCH PRESENTS outlook mid year 2022- Midterms’ arrival affects policy outlook

Midterm elections are often a balancing act for voters, historically tilting heavily against the sitting president’s party. Since 1900, the president’s party has lost House seats in midterms 87% of the time, averaging 30 seats lost (remember, all House seats are up for re-election in midterms). In the Senate, where only about one-third of seats are up for grabs, the president’s party has lost seats 67% of the time with an average loss of three seats. More recently, losses have been more extreme, with President Obama losing 63 seats and President Trump losing 41. The only president to add seats in recent times is George W. Bush, riding a wave of support after 9/11, when the Republicans added 8 seats.

Democrats would have a difficult path to hold their current slim majorities in the House and Senate if they were only facing historical trends. Add in President Biden’s low approval rating, which correlates with midterm performance, and weak consumer confidence due to high inflation, and the odds heavily favor Republicans taking the House. Republicans seem to be moderate favorites in the Senate. The make-up of seats up for re-election favors Democrats, with 21 Republicans up for re-election in November compared with 14 Democrats. But genuine toss-up seats are more evenly matched and Republicans only need to flip one seat to become the majority party.

Historical impact of midterms on markets

One of the things we knew coming into this year was that 2022 will be a midterm year—and those have historically not been kind to stocks. In fact, since 1950, midterm years have seen the largest peak-to-trough pullback of the four years of the presidential cycle, with the S&P 500 Index down 17.1% on average during the year (the max drawdown this year for the S&P 500 has been 23.5%, as of June 27). The good news is, one year off those lows, stocks have been up more than 32% on average.

Also consider the first half of the year is historically one of the weakest parts of the entire four-year presidential cycle, matching up quite well with what we saw in 2022. But by the time the election rolls around in November, many of the policy worries are lifted, as the uncertainty of the election is over. Voters might not like the results, but stocks can adapt and move forward once the election uncertainty is gone.

And move forward they have. The year after midterm elections has historically been quite strong for stocks. Incredibly, the S&P 500 has been higher a year after every midterm election since 1950. That is 18 out of 18 years, with the average gain a year later a very solid 14.5% [Fig. 10]. Breaking it down by presidential party doesn’t show much difference, up 14.8% under a Republican and 14.5% under a Democrat.

Less uncertainty, divided government often preferred

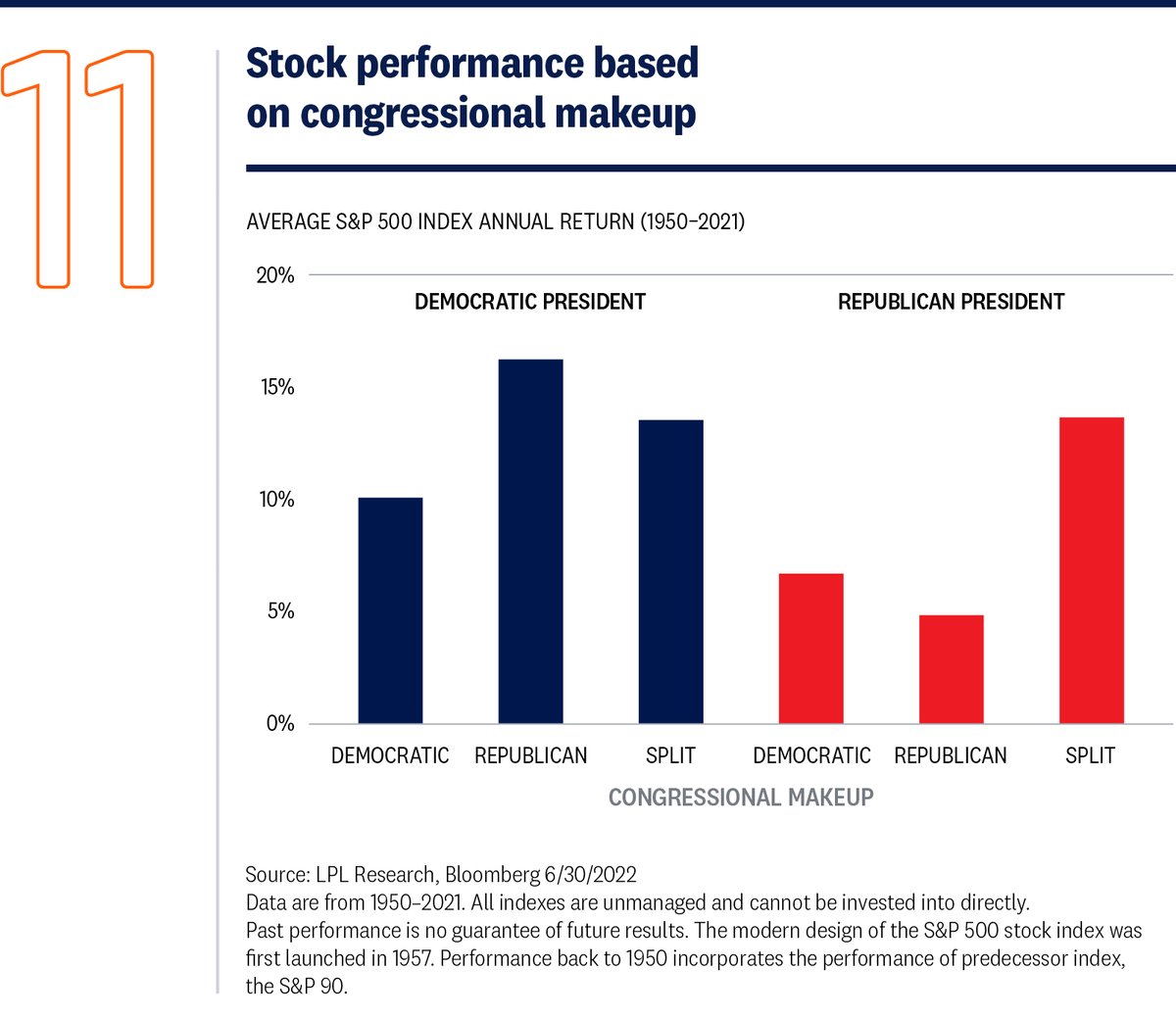

Markets hate uncertainty and we know that midterm elections can bring with them a good deal of uncertainty. What could it mean if history repeats and the Republicans take over both the House and Senate this coming November? Well, one of the best scenarios under a Democratic President is Republican control of Congress, with the S&P 500 up an average of 16.3% during those years—hard for investors to ignore. What if the Democrats hold onto the Senate, but lose the House (the second most likely scenario)? That combination has also been quite strong for stocks historically, with the S&P 500 gaining 13.6% on average during those years [Fig. 11].

Either way, it looks like divided government is in the cards, which markets have historically liked. That may be because neither party is able to give in to its worst excesses, because the parties are forced to find common ground, or possibly because little gets done and sometimes the government that governs best is the one that governs least.

Strong prospects for divided government in 2023 are fueling Democrats’ last-ditch effort to get a “skinny” reconciliation bill through Congress before midterms, though we are skeptical. Tax increases on the ultra-wealthy, alternative energy tax credits, and drug price reform are policies to watch that could potentially be market moving if Senators Joe Manchin and Kyrsten Sinema can be brought on board.

What midterms could mean for 2024

Finally, in a very early note on the 2024 presidential election, midterm weakness has not been predictive of the next presidential election. Presidents Reagan, Clinton, and Obama all lost more than 20 seats in their midterms and won reelection. But approval ratings have mattered, and with President Biden’s approval rating at about the same level as President Trump’s at the same point in his term, winning a second term looks like a daunting task from the current perspective, although November 2024 is still far away.

Alternatives, commodities, and currencies

Alternative strategies show diversification potential

As we look back on the first half of 2022, the market environment has provided a compelling reminder of the potential benefits of including alternative investment strategies within portfolios. While investors have often been rewarded for focusing exclusively on traditional stocks and bonds over the past decade, significant losses across both markets in 2022 left many searching for ways to further diversify exposures. While alternatives cover a wide range of approaches, several have helped fill that gap, and may continue to do so over the rest of the year.

As discussed in LPL Research’s Outlook 2022: Passing the Baton, we continue to believe our preferred alternatives implementations—event-driven strategies, market neutral strategies, and relatively conservative low volatility approaches—have the ability to act as a source of ballast during such periods of high volatility, especially when both stocks and bonds struggle at the same time. While we look for alternatives to act as a source of diversification from traditional risks, we’re also stressing diversification within alternative allocations. While all the previously mentioned strategies may mitigate traditional sources of portfolio risk, selectively adding these alternative strategies as bond diversifiers in particular may be appropriate to hedge against potential further bouts of bond volatility. We continue to emphasize these lower volatility alternative strategies that can play this role as we look ahead to the second half of 2022.

Should commodity investors prepare for landing?

Commodities enjoyed a strong first half, though recent weakness endangers some uptrends. The Bloomberg Commodity Index has gained more than 23% so far in 2022, far outpacing losses for the major stock and bond market indexes. Energy was the headliner, not surprisingly, with oil and natural gas up 55% and 80%. A strong U.S. dollar, normally a headwind for commodity prices, didn’t seem to slow commodities’ ascent at all.

Commodities have garnered support from both the demand and supply sides. Demand has gotten a lift as the global economy emerged from the worst of the pandemic. Sanctions on Russian energy exports have kept oil and gas prices elevated, particularly the ban on imports of seaborne Russian oil into the European Union, accounting for roughly two-thirds of Russia’s crude deliveries to the region. Ukraine is an important global supplier of agricultural commodities such as corn and wheat, putting upward pressure on food prices, while some key metals also come from the region.

Upward pressure on commodity prices will likely persist for at least the next several months, bolstered by China’s reopening, the U.S. summer driving season, tight inventories, and disciplined capital investment by domestic oil and gas producers. A potential cease-fire in Ukraine is a wildcard, but sanctions on Russian oil aren’t going away anytime soon and energy and other commodities were in uptrends before Russia’s invasion.

From an investment perspective, we would favor energy, followed by precious metals then industrial metals. The highest profile industrial metal, copper, has not participated in the commodities rally, while other parts of the industrial metals complex appear to have topped. We would expect gold, which has been range-bound for nearly two years now and tends to do better when the dollar is weak, to be hurt by rising interest rates.

Greenback has taken off in 2022

As we enter the second half of 2022, the factors that led to a sharp and nearly uninterrupted ascent for the U.S. dollar may begin to reverse. A hawkish Federal Reserve is intent on reining in inflationary pressures by softening the economic backdrop. Perhaps the most important underlying dynamic for the U.S. dollar against foreign currencies is the interest rate differential. As such, a Bank of Japan insistent on keeping the yen near multi-decade lows and a European Central Bank that will lag the Fed in its interest rate cycle may keep upward pressure on the greenback in the short term.

In the intermediate term, easing inflation from unsnarling of supply chains post-COVID, aided by China’s reopening, could help push the dollar lower. Meanwhile, less demand for so-called “safe havens” in the event of a possible cease-fire in Ukraine, though difficult to predict, could also push the dollar lower. Finally, the massive trade and budget deficits should be dollar negative over time.